maryland earned income tax credit 2020

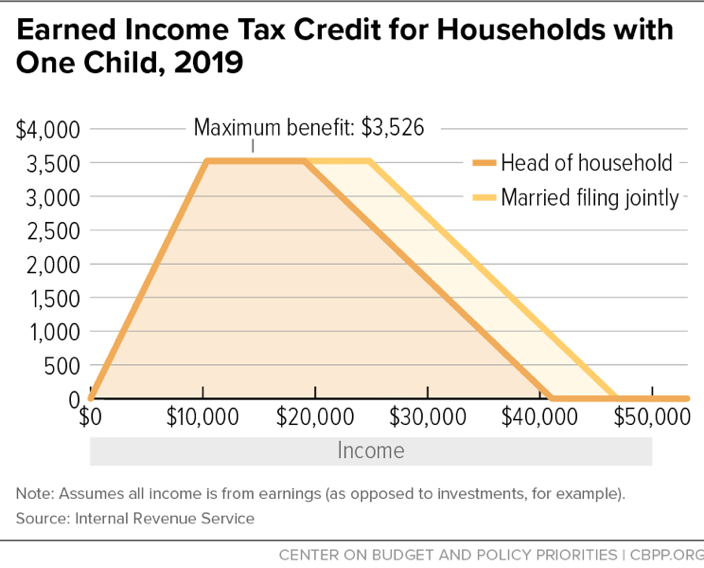

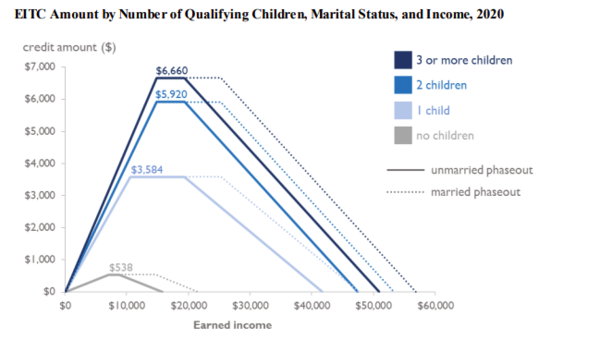

The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. See Worksheet 18A1 to calculate any refundable earned income tax credit.

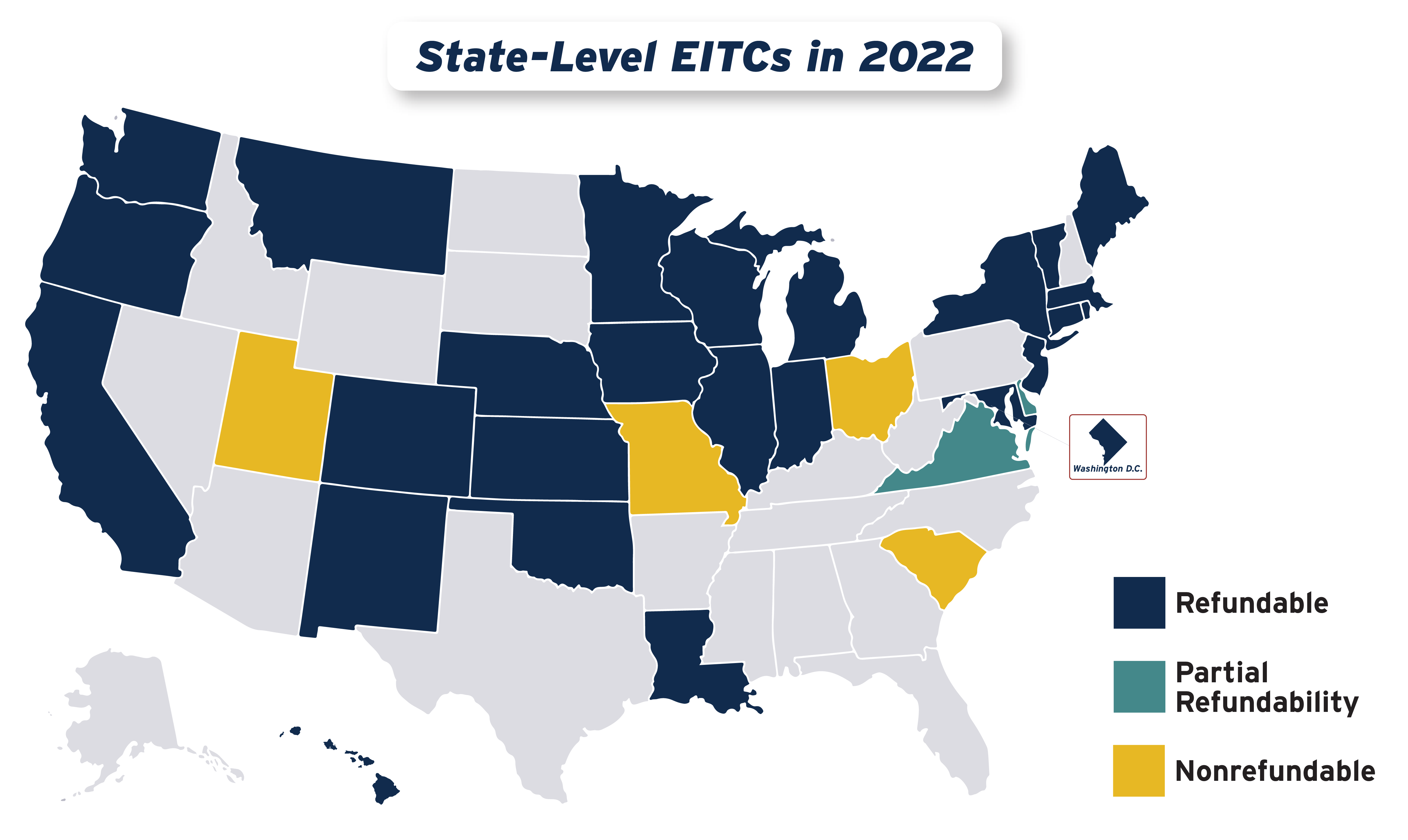

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the.

. Printable New York state tax forms for the 2020 tax year will be based on income earned between January 1 2020 through December 31 2020. See Marylands EITC information page. Your employees may be entitled to claim an EITC on their 20 20 federal and Maryland resident income tax returns if both their federal adjusted gross income and their earned income is less.

50 of federal EITC 1. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. Recent Out of Africa Theory is Wrong.

Karen is due two Earned Income Tax Credits calculated as follows. Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of. Modern Humans Interbred with.

50000 x 20 10000 Maximum Earned Income Tax Credit available 1700. The expanded tax credit will arrive as soon as they file their 2020 tax returns and they will be eligible to receive that higher amount for the next three years. Allowable Maryland credit is up to one-half of the federal credit.

Get your earned income credit with free filing. Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. SB 717 increases access to the Maryland Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes.

28 of federal EITC. If you qualify you can use the credit to reduce the taxes you owe. If you are claiming a federal earned income credit EIC enter the earned income you used to calculate your federal EIC.

The earned-income credit EIC is a tax credit that is intended to help low and middle-earning UStaxpayers by reducing the amount of federal tax that is owed. Earned Income Tax Credit EITC Rates. For 2020 the income.

The Comptroller of Maryland will allow a Maryland income tax credit for the amount certified by the Department of Natural Resources not to exceed the lesser of 1500 per taxpayer or the. Earned income includes wages salaries tips professional fees and. Ad Premium federal filing is 100 free with no upgrades for premium taxes.

Archaeology Places Humans in Australia 120000-Years-Ago. If you either established or abandoned Maryland residency during the calendar year you are considered a part-year resident. E-File your tax return directly to the IRS.

Form may be used by resident and nonresident individuals to report income modifications applicable to tax year 2020 that are enacted during the 2021 legislative session including. See instruction 26 in the Maryland Tax Booklet for more. To be eligible for the federal and Maryland EITC your federal adjusted gross income and your earned income must be less than.

FEBRUARY 26 2020 Expanding Marylands Earned Income Tax Credit Will Benefit Families and the Economy Position Statement Supporting Senate Bill 619 Given before the Senate Budget. If you qualify for the federal earned income tax credit and claim it on your federal. In a 91-44 vote lawmakers passed an.

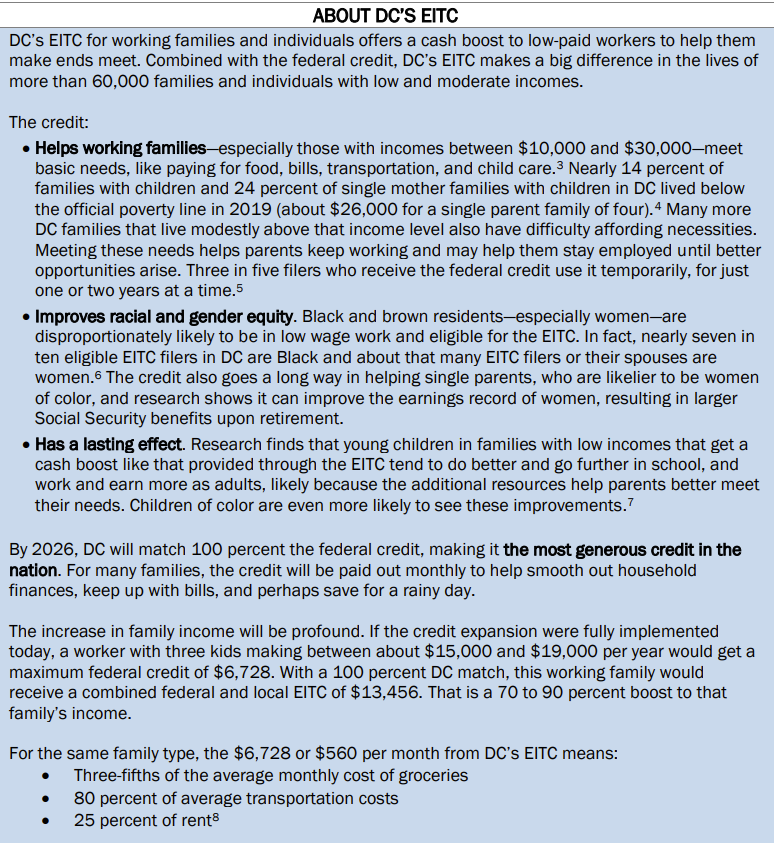

10-913 2020 a 1 On or before January 1 of each calendar year the Comptroller shall publish the maximum income eligibility for the earned income tax credit. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years. Maryland earned income tax credit notice 2020.

Montgomery Council Approves Fy 21 Budget Fy 21 26 Cip Conduit Street

9m In More Tax Credits Available For Maryland Student Loan Debt

Mdhs Advises Eligible Marylanders To Utilize The Earned Income Tax Credit The Baynet

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Among New Maryland Laws Effective Monday Help For Parents Paying Thousands Of Dollars For Child Care Baltimore Sun

Earned Income Tax Credit Wikipedia

Maryland Approves Coronavirus Aid For Undocumented Immigrants Npr

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Earned Income Credit H R Block

Who Gets Checks Tax Breaks And When From Maryland S Coronavirus Pandemic Relief Act Package Baltimore Sun

State Individual Income Tax Rates And Brackets Tax Foundation

Maryland Volunteer Lawyers Service Eitc Can Give Qualifying Workers With Low To Moderate Income A Substantial Financial Boost To Receive The Credit People Must Meet Certain Requirements Use The Irs Eitc Assistant To Check

Income Tax Season 2022 What To Know Before Filing In Maryland Annapolis Md Patch

Maryland Refundwhere S My Refund Maryland H R Block

What Is The Earned Income Tax Credit

Md 502up 2020 2022 Fill Out Tax Template Online

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep